|

| (c) Ramey Layne and Brenda Lenahan, Vinson & Elkins LLP |

SPAC explained and a comparison to operating company IPO process

I found an interesting article, well explaining SPACs from Layne and Lenahan.

Ramey Layne and Brenda Lenahan are partners at Vinson & Elkins LLP. This post is based on a Vinson and Elkins publication by Mr. Layne, Ms. Lenahan, Terry Bokosha, Mariam Boxwala, and Zach Swartz.

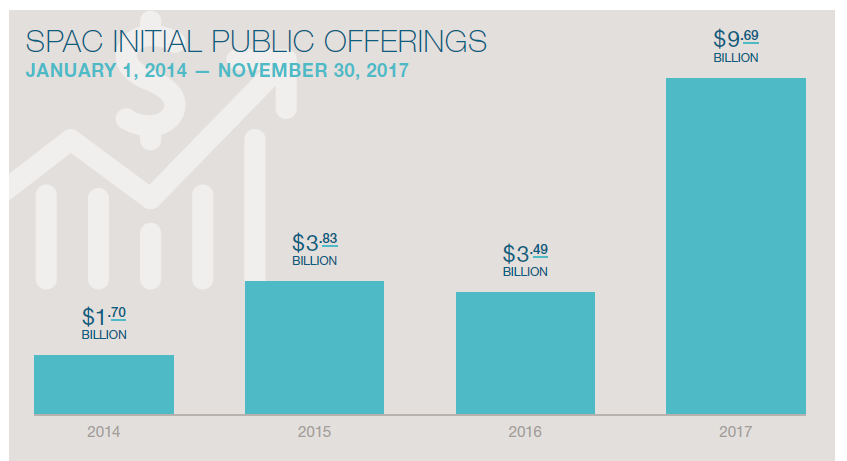

Special Purpose Acquisition Companies (“SPACs”) are companies formed to raise capital in an initial public offering (“IPO”) with the purpose of using the proceeds to acquire one or more unspecified businesses or assets to be identified after the IPO. From the beginning of 2014 through November 30, 2017, almost 80 SPAC IPOs have closed, raising approximately $19 billion in gross proceeds.

A SPAC will go through the typical IPO process of filing a registration statement with the U.S. Securities and Exchange Commission (“SEC”), clearing SEC comments, and undertaking a road show followed by a firm commitment underwriting. The IPO proceeds will be held in a trust account until released to fund the business combination or used to redeem shares sold in the IPO.

Read more at Harvard Law School Forum of Corporate Governance

Kommentare

Kommentar veröffentlichen